DEGREES IN Accounting

Accounting Associate of Applied Science

By the Numbers

Accounting Clerk Diploma

By the Numbers

Accounting Diploma

By the Numbers

Why Choose This Program

Employers value SCTCC accounting graduates. Our graduates can work almost anywhere, including firms specializing in tax prep or audits, large and small businesses, or various government agencies.

After completing the AAS degree, SCTCC students can take the national Accredited Business Accountant (ABA) accreditation and the State of Minnesota Registered Accounting Practitioner (RAP) exams.

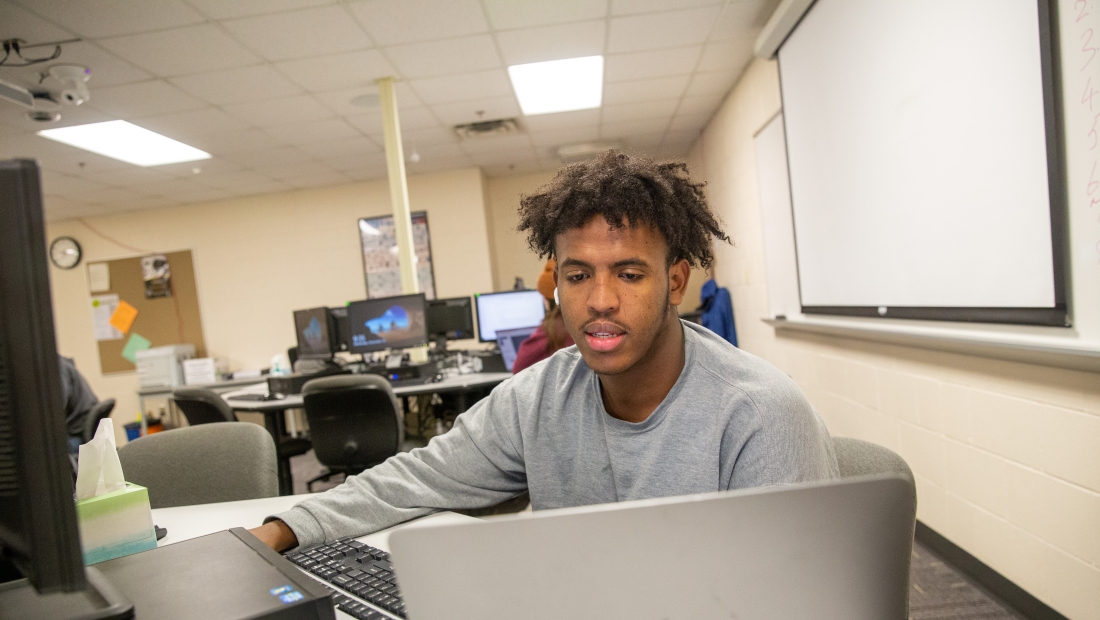

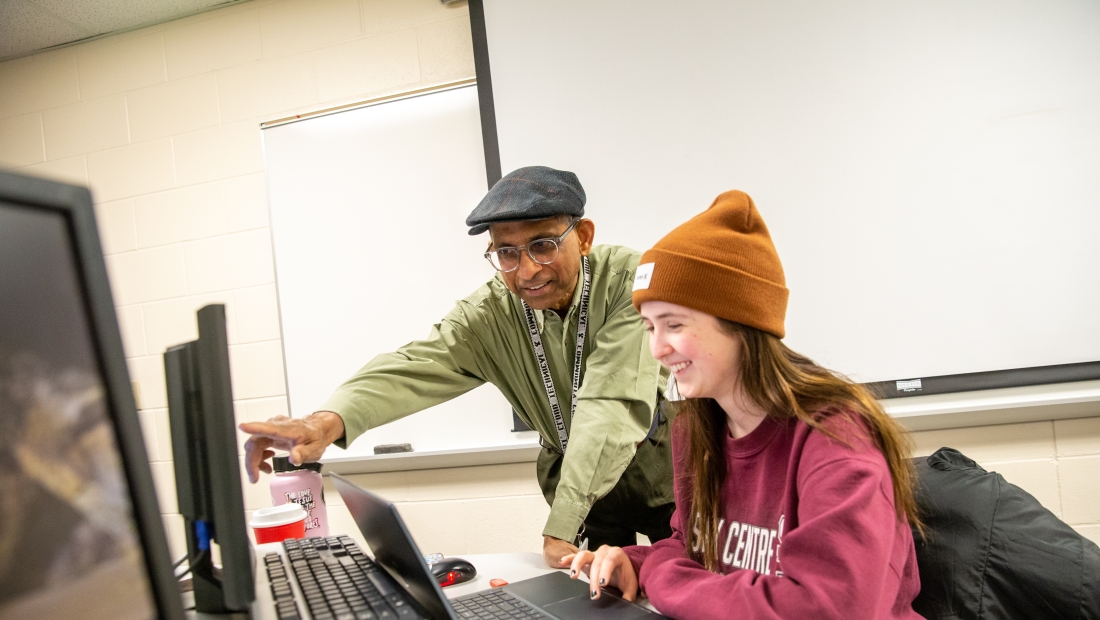

SCTCC is one of the top two-year accounting programs in the country; with small class sizes and hands-on learning, students are bound to find success in their future careers.

Our graduates historically have passed the national accounting accreditation exam at a rate 2-3 times higher than the national average. SCTCC has more graduates pass the exam than any other two-year college.

This program is available online and on campus. Learn more about Online classes and programs

Placement rate is self-reported data of graduates available for work in field of study up to one year post graduation. Wage data is from Minnesota Dept. of Employment and Economic Development (DEED). SCTCC Consumer Information.

From Degree to Career

When you choose the Accounting program at SCTCC, you’ll gain skills that will directly transfer to the workplace. There are several employers in the St. Cloud area that are ready to hire accountants, including Marco, Stearns County, Miller Auto Center, and more.

SCTCC’s program prepares you for the workforce. We teach students all the skills required to be a successful graduate with an accounting degree. Our program ensures every student knows the requirements future employers are looking for.

After graduation, students will be able to identify and journalize economic transactions, prepare and interpret financial statements in accordance with Generally Accepted Accounting Principles, and will know basic business math concepts and calculations.

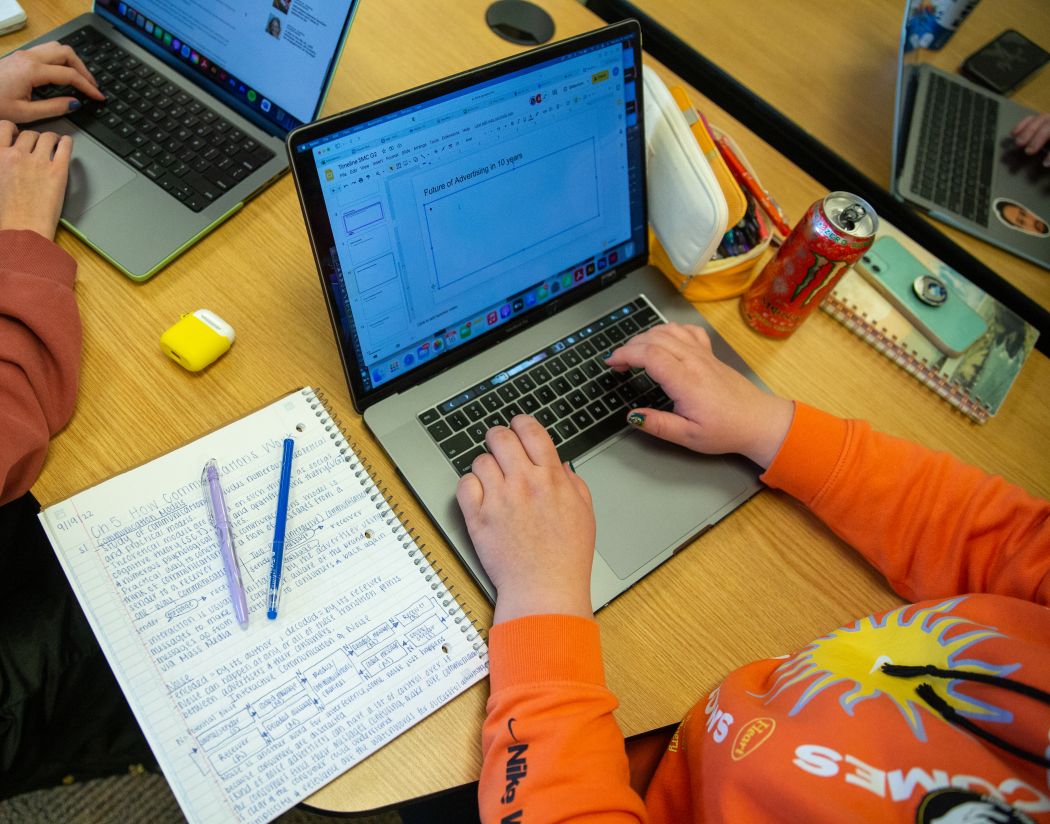

Graduates are equipped with computer knowledge in accounting and important business application software, such as QuickBooks and RIA Checkpoint, and the skills to apply audit techniques and report findings to present correct and fair financial statements.

SCTCC teaches students how to file tax returns and we ensure all students understand the ins and outs of federal partnership and corporate tax returns. Graduates know how to calculate, record, and report payroll and all related payroll taxes.

Our graduates learn legal concepts to understand contract law and the judicial system, general business concepts, from business formation, management, and economics. Graduates will know the financial and managerial accounting functions in a manufacturing, governmental, or non-profit environment.

Quick Glance

- Identify and journalize economic transactions.

- Prepare and interpret financial statements in accordance with Generally Accepted Accounting Principles.

- Computer knowledge in accounting and business application software, like QuickBooks and RIA Checkpoint.

- Basic business math concepts and calculations.

- Apply audit techniques and report findings to present fair financial statements.

- Legal concepts, contract law, and the judicial system.

- General business concepts, business formation, management, and economics.

- Federal and state personal income tax law, filing annual returns, and federal partnership and corporate tax returns.

- Financial and managerial accounting functions in a manufacturing environment.

- Calculate, record, and report payroll and all related payroll taxes.

- All accounting functions in a governmental or non-profit environment.

View all program learner outcomes

An accounting degree with SCTCC has multiple career paths. You can find many of our recent graduates working as auditors, financial analysts, tax accountant/tax preparers, business managers, purchasing managers, financial consultants, bankers, and business owners.

We have graduates working as various types of accountants, from financial, cost, to managerial accountants.

A day in the life of our graduates consists of working with well-known companies, such as retail companies or government agencies. As a SCTCC graduate, you are certain to find success within your career.

SCTCC prepares you to work with a variety of different employers, from CPA Firms to service and manufacturing companies. You are certain to find a career after graduating with an accounting degree.

Other possible employers with an accounting degree are service companies, government agencies, non-profit organizations, and banks.

Quick Glance

Types of Careers

- Auditor

- Financial Accountant

- Tax Accountant/Tax Preparer

- Managerial Accountant

- Cost Accountant

- Business Manager

- Financial Consultant

- Financial Analysts

- Purchasing Manager

- Business Owner

- Banking

Potential Employers

- CPA Firms

- Service Companies

- Retail Companies

- Manufacturing Companies

- Government Agencies

- Non-profit Organizations

- Banks

Many of SCTCC’s graduates go on to work in the community of St. Cloud. An accounting degree with SCTCC has gotten our graduates jobs with a wide range of companies. Our graduates can get a job with leading companies such as:

- Marco

- Amazon

- GATR Truck Center

- Xcel

- Stearns County

- St. Cloud Technical and Community College

- Anderson Gilyard

- Miller Auto Center

Students completing the Accounting AAS Degree are eligible to take the National Accredited Business Accountant (ABA) accreditation and the State of Minnesota Registered Accounting Practitioner (RAP) accreditation exams.

In past years, SCTCC graduates have a pass rate more than 2-3 times higher than the national average on the national accreditation exam.

Ready to Take the Next Step?

Are you ready to learn more about the Accounting program and being a student at SCTCC?

Fill out this form to receive useful information that's specific to your program.

- Call us at 320-308-5089

-

Email us at recruitment@sctcc.edu

- On campus Monday-Friday, 8 a.m.-4:30 p.m.

Visiting campus is an excellent opportunity to learn about SCTCC programs, the application process, and tour the state-of-the-art-labs and classrooms.

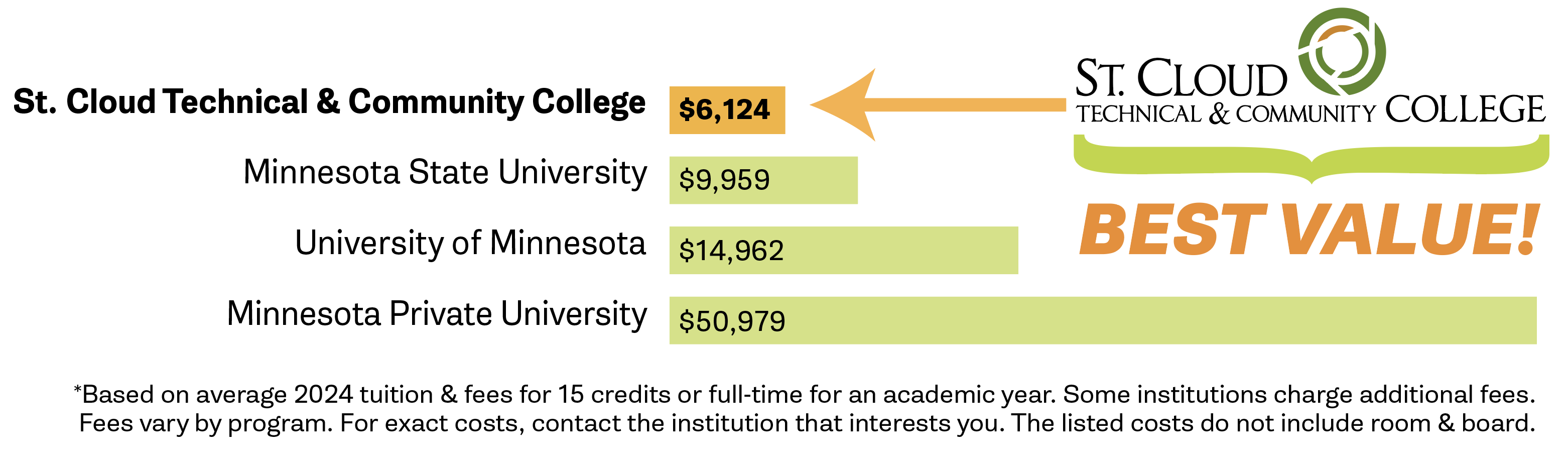

Paying for College

Students choose SCTCC for a lot of reasons, but saving money is one reason we hear from almost every student at SCTCC. We’ve got a breakdown of the costs for the program, along with information on financial aid and scholarships.

Apply just once and you are considered for all eligible SCTCC scholarships. There are scholarships available specifically for students in the Accounting program.

Accounting Instructor

More Like Accounting

Business